A stand-alone benefit that provides beneficiaries with a monthly pay-out for a 6, 12 or 24 month period.

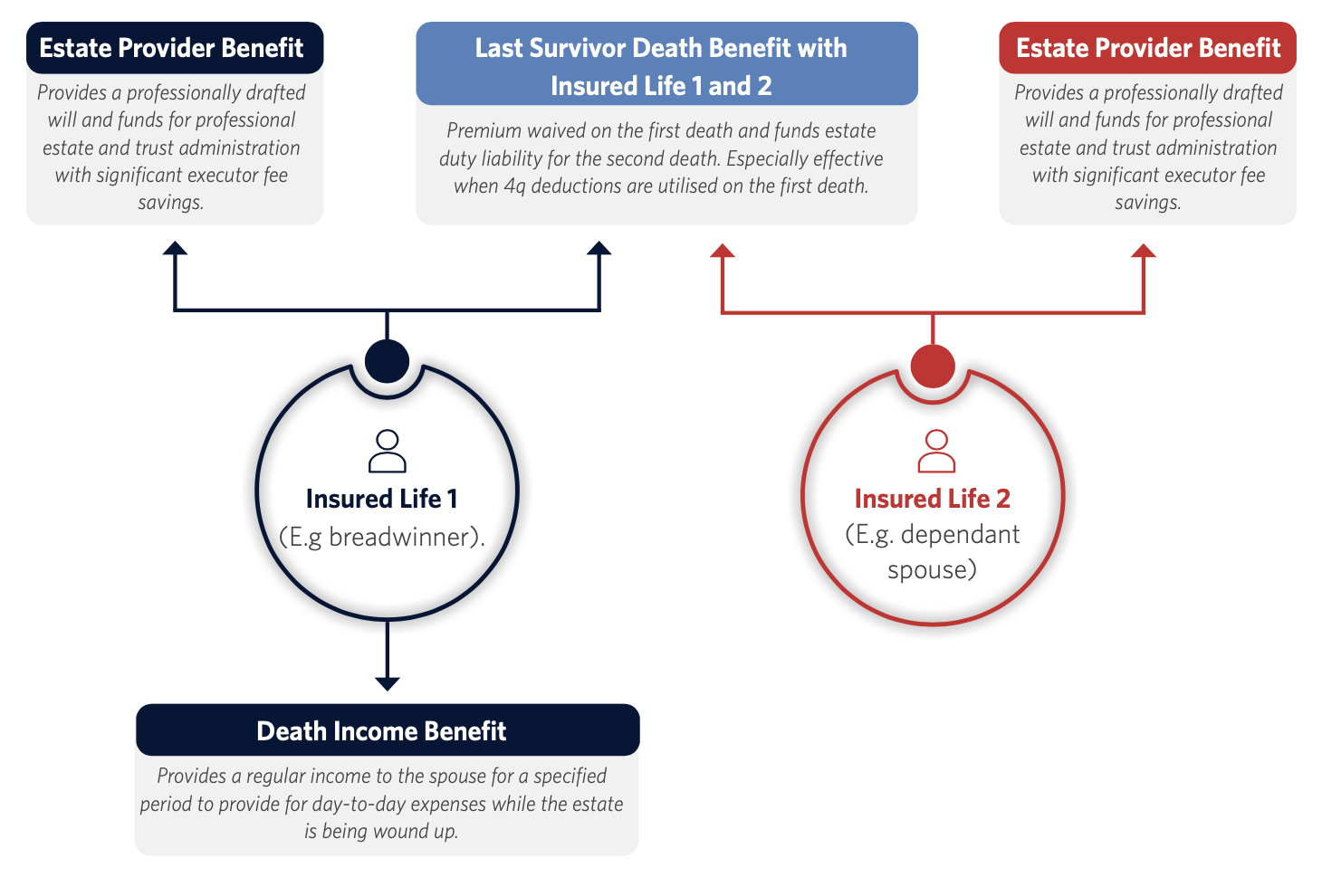

The Death Income Benefit is a stand-alone benefit that offers your clients peace of mind in knowing that, in the event of their death, their dependants will be financially provided for with a regular monthly income to cover any ad hoc, day-to-day or regular expenses.

Why is this important?

If your clients die, their dependants will be liable for expenses that they may not have previously covered, for example; medical aid expenses, utility bills, bond repayments and other general living expenses that will be required to maintain their lifestyle. The Death Income Benefit allows your clients to proactively plan for this eventuality, by providing a regular replacement income for a specified period.